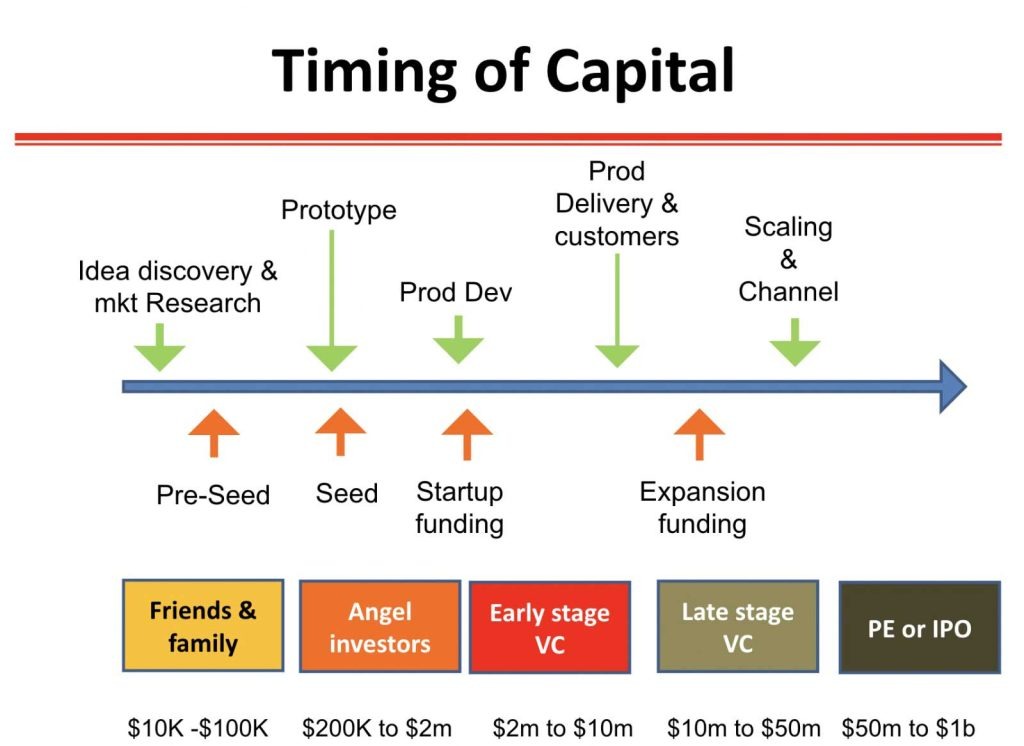

Idea discovery – An entrepreneur spends own money in search of ideas and market research.

Pre-seed funding – Entrepreneur goes to friends and family to further develop the idea. Typical investing in this phase is $10K-$100K.

Seed Funding – To develop a prototype, seed funding is needed ranging from $100K to $2 million.

Startup Funding – Product development phase where early-stage VCs get involved and invest in the range of some $millions.

Product Delivery and Customer Acquisition – Operations cost, marketing and sales become primary expenses at this stage and show market viability of a product.

Late Stage VC Funding for Scaling – Expanding market share is the key objective and funding may vary from business to business. Pre-IPO or IPO – Primarily focused on taking the company public as part of exist strategy for investors.

The following diagram from Naeem Zafar can provide additional timeline information for funding rounds.